Why buy bonds when CDs and money markets are paying so much?

- Wayne Jordan

- Jul 18, 2023

- 2 min read

Updated: Oct 24, 2023

I wrote a couple of months back about how much better CD and money market rates are now compared to previous years. (LINK) Currently you can still get interest rates above 5% on these products: https://www.bankrate.com/banking/cds/cd-rates/.

For money just sitting in cash without taking much risk that is pretty darn good.

That leads into a question we’ve been getting more often recently:

If I can get 4 or 5% just sitting in a CD, why would I add the additional risk of buying bonds or bond funds? Why not just stash all of my non-stock money into CDs or money markets?

These higher rates are great for money you’ve got sitting idle or maybe earmarked for a project/purchase coming up.

However, for your long-term portfolio bond funds still do a better job of achieving growth and outpacing inflation compared to CDs and money market funds.

I found a great John Hancock article that has some solid points worth discussing more. LINK

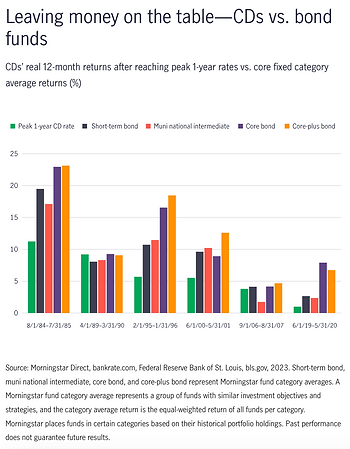

1) Let’s compare the performance of bonds to CDs, when CDs are paying their highest:

Going back to 1984 CD rates have peaked 6 times.

How have bond funds performed during those years that CD rates peaked? Actually pretty darn well.

In 1984 you could buy a CD returning 12% after inflation…that’s a killer return!...but not when you compare it to how the average bond fund performed that year. All bond categories had real returns (after inflation) above 15% each.

You can see the result is the same during each CD rate peak; bond funds outperform the CD.

2) Bond fund yields adjust to inflation quicker.

When you buy a CD your rate is locked in for the entire period. This could be as short as one month or as long as 10 years. No matter what happens with inflation you are locked in.

If inflation goes down you’re thrilled because you are locked in at a higher rate.

If inflation increases you're stuck with this lower rate.

Bond funds on the other hand are able to adjust quicker to inflation. How?

A bond fund holds thousands of different individual bonds. Some of these bonds are maturing every day. When this happens the fund manager buys new bonds to replace the maturing ones, and these newer bonds pay the current market interest rate.

By constantly re-investing the proceeds the bond fund yield/interest adjusts to the current market environment, unlike CDs that have a locked interest rate.

Both CDs/money markets and bond funds are great tools in your financial toolbox, but they’re not perfectly interchangeable and it’s important to know when you should be using one or the other.

Comentarios